vermont income tax rate 2021

Your 2021 Tax Bracket to See Whats Been Adjusted. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Vermont Income Tax Calculator Smartasset

Tax Rates and Charts.

. Single If VT Taxable Income is Over But Not Over VT Base Tax is Plus Married Filing Separately Schedule Y-2 Use if your filing status is. Ad Answer Simple Questions About Your Life And We Do The Rest. Individuals earning 200-500K pay a higher marginal rate in Vermont 875 than in any other state.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. Tax Rates Tax rates can be fixed or tiered. Find your pretax deductions including 401K flexible account contributions.

Vermont collects a state corporate income tax at a maximum marginal tax rate of 8500 spread across three tax brackets. Vermonts average education income tax rate would presumably be higher than any of these states average local rates. Tax Rates and Charts Thu 12162021 - 1200.

Tax Rate 0. 6 In New Jersey A10 was enacted in September 2020 expanding the states so-called millionaires tax. Base Tax is 2727.

This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it is made available by the Vermont government. 2017 VT Tax Tables. How to Calculate 2021 Vermont State Income Tax by Using State Income Tax Table.

2019 Income Tax Withholding Instructions Tables and Charts. Subtract 75000 from 82000. 2022 Interest Rate Memo.

2021 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Taxvermontgov Page 42 2021 Vermont Tax Rate Schedules.

This law raised income taxes by reducing the kick-in for the states top marginal individual income tax rate. 2022 Income Tax Withholding Instructions Tables and Charts. The appropriate schedule is determined by a special formula in the Vermont Unemployment Compensation Law.

Detailed Vermont state income tax rates and brackets are available on this page. And Is employed by an employer who attests that after reasonable time and effort the employer was unable to fill the employees. Wage-report-FINAL-1-16-2021pdf rate as updated 11521 in accordance with 2 VSA.

And Incurred qualified relocation expenses. Liability increases smoothly from bracket to bracket. Currently this is 1339 perhr.

Find your gross income. FY2022 Education Property Tax Rates. Vermont Income Tax Calculator 2021 If you make 120000 a year living in the region of Vermont USA you will be taxed 25834.

Or Civil Union Filing Separately of the amount over If VT Taxable Income is Over But Not Over VT Base Tax is Plus of the. Discover Helpful Information and Resources on Taxes From AARP. 2021 Vermont Tax Tables.

For tax year 2021 Michigans personal exemption has increased to 4900 up from 4750 in 2020. There are a total of eleven states with higher. Filing Status is Married Filing Jointly.

Your average tax rate is 1651 and your marginal tax rate is 24. 2021 Vermont Tax Rate Schedules Single Individuals Schedule X Use if your filing status is. 2021 Income Tax Return Booklet 2021 Vermont Income Tax Return Booklet.

The tax schedules are designed so that Rate Schedule 3 provides an equilibrium of funding across the. Find your income exemptions. This booklet includes forms and instructions for.

And Is subject to Vermont income tax. Any income over 204000 and 248350 for SingleMarried Filing Jointly would be. This 2021 Vermont Tax Expenditure Report is a continuing effort to catalogue all exemptions exclusions deductions credits preferential rates or deferral of liability as defined in 32 VSA.

Add this amount 462 to Base Tax 2727 for Vermont Tax of 3189. Tue 01252022 - 1200. 2016 VT Rate Schedules and Tax Tables.

2017-2018 Income Tax Withholding Instructions Tables and Charts. Tax Rates and Charts Wed 08182021 - 1200. A financial advisor in Vermont can help you understand.

Tiered rates are typically structured as a series of brackets. 312 a applicable to the states major tax sources and provide. IN-111 IN-112 IN-113 IN-116 HS-122 RCC-146 HI-144.

Ad Compare Your 2022 Tax Bracket vs. Section 1326 of the Vermont Unemployment Compensation Law provides five different rate schedules each with twenty-one tax rates. VT Taxable Income is 82000 Form IN-111 Line 7.

Meanwhile total state and local sales taxes range from 6 to 7. As you can see your Vermont income is taxed at different rates within the given tax brackets. Income tax rate comparison2 Vermonts existing top marginal rate 875 is one of the ten highest in the nation.

The Vermont tax rate is unchanged from last year however the income tax brackets increased due to the annual. 2017-2018 Income Tax Withholding Instructions Tables and Charts. Taxpayer pays only the assigned rate for each.

2017 VT Rate Schedules. We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes. Check the 2021 Vermont state tax rate and the rules to calculate state income tax.

Vermonts sales tax is an example of a fixed rate. Most tiered rates are structured to be progressive. Vermonts income taxes are examples of tiered rates.

Tax Year 2021 Personal Income Tax - VT Rate Schedules. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. Multiply the result 7000 by 66.

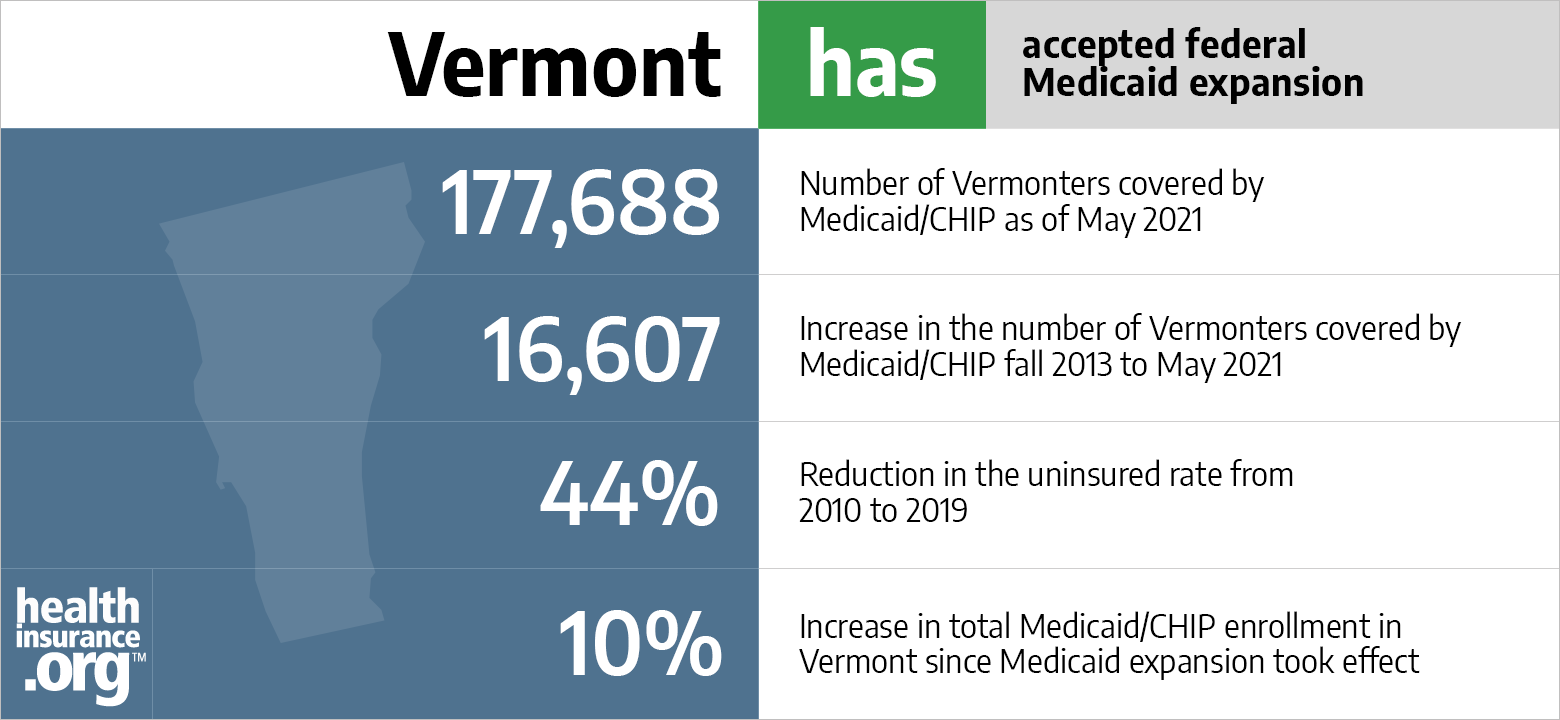

Aca Medicaid Expansion In Vermont Updated 2022 Guide Healthinsurance Org

Vermont Retirement Tax Friendliness Smartasset

Vermont Income Tax Brackets 2020

Vermont Sales Tax Guide And Calculator 2022 Taxjar

West Virginia Has Some Of The Lowest Property Taxes In The Nation As Indicated In White On This Map Property Tax Map Us Map

Publications Department Of Taxes

Personal Income Tax Department Of Taxes

Vermont Tax Forms And Instructions For 2021 Form In 111

Vermont Income Tax Calculator Smartasset

Personal Income Tax Department Of Taxes

Vermont Income Tax Calculator Smartasset

Which States Have The Lowest Property Taxes Property Tax Usa Facts History Lessons

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Filing A Vermont Income Tax Return Things To Know Credit Karma

What To Know About Vermont S Property Transfer Tax Vhfa Org Vermont Housing Finance Agency